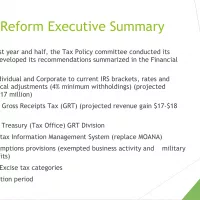

A new revenue generating measure that the administration has been reviewing is a Gross Receipts Tax (GRT).

This tax will be placed on goods and services sold by companies in American Samoa.

Unlike the excise tax, which taxes goods coming into the port, services like bank fees, consulting fees and mobile phone calls, will be taxed under the GRT proposal.

It was explained at a presentation by ASG officials for the private sector held last month that the GRT is supposed to offset the revenue that will be lost, $16-17 million, by bringing the tax table from 2000 to 2020.

The recommended GRT is 4%, while some activities will have a reduced rate of 1%-2% or 0%.

Business representatives at the meeting asked why doesn’t ASG just reduce spending by $16 million, instead of putting in a new tax; stated the tax rate was too high and would have an inflationary effect; and that whatever the government decided should be to make it hard for cheaters to gain an advantage over honest business people.

It is estimated that the GRT will bring in $17-18 million of additional revenue for ASG.

By comparison, this amount is almost equal to the $18.5 million of corporate taxes ASG expected to collect in FY2023. Essentially, the GRT, if passed, will double corporate taxes.

ASG projected that it will collect $28.4 million in individual taxes, and $27.6 million in excise taxes in FY2023.

It should be noted that ASG exceeded their corporate and individual tax collection targets in FY2022 by $5.1 million and $20.1 million, respectively.

For FY2023, it is projected that ASG will exceed corporate and individual tax targets by $20.9 and 17.2 million, respectively.

By the third quarter of FY2023, ASG had exceeded their annual targets by $2.8 and $15.5 million, respectively.

Any new tax must be approved by the Fono and it remains to be seen whether or not the GRT would be on the agenda for the current session, which will end on two weeks.

Treasurer Malemo Tausaga told the Senate Budget and appropriation Committee yesterday that a $17 million surplus, which was recorded in the third quarter performance report for ASG, was the result of extra ordinary revenue collections.

Going by his testimony and the reported surplus, ASG should be able to implement the tax table changes without the GRT.